Table of Contents

Introduction

Starting an ATM Business is a lucrative opportunity that allows entrepreneurs to generate passive income with minimal effort. As the demand for cash transactions remains steady in various industries, owning and operating ATMs can be a profitable venture. This comprehensive guide on starting an ATM business will walk you through three easy steps to successfully launch your ATM business, covering everything from market research to machine selection and legal requirements. Whether you’re a beginner or an experienced entrepreneur, these steps will help you navigate the process efficiently.

Advantages of Starting an ATM Business

Operating an ATM Business offers several benefits, making it an attractive venture for those looking to build passive income streams. Some key advantages include:

Recurring Revenue and Passive Income

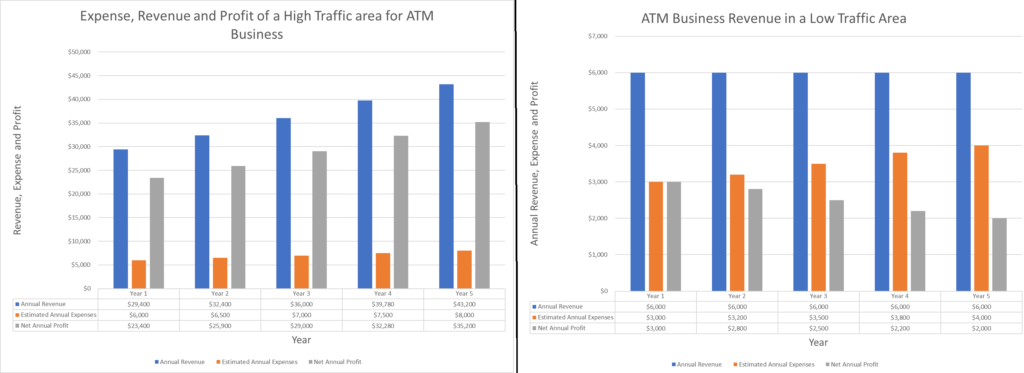

One of the biggest advantages of starting an ATM Business is the ability to generate consistent, recurring revenue. Each time a customer withdraws money from your ATM, you earn a surcharge fee. These fees add up over time, especially if your ATM is in a high-traffic location. Unlike traditional businesses that require constant management and customer interactions, an ATM operates 24/7, allowing you to earn money even while you sleep. With minimal hands-on effort, you can build a reliable stream of passive income over time. Learn more about how you can start an ATM Business with no money and still generate revenue effectively.

Low Maintenance and Operational Effort

Compared to other business models, an ATM Business requires very little day-to-day involvement. Once your machine is installed and operational, your primary responsibilities include restocking cash, performing occasional maintenance, and monitoring transactions. Most modern ATMs come equipped with remote monitoring software, allowing you to track cash levels and troubleshoot issues from anywhere. You can also outsource maintenance and cash-loading tasks to third-party companies, further reducing your workload. This makes the ATM Business an excellent option for those looking for a semi-passive income opportunity. Check out this trusted ATM Business solution for seamless setup and management.

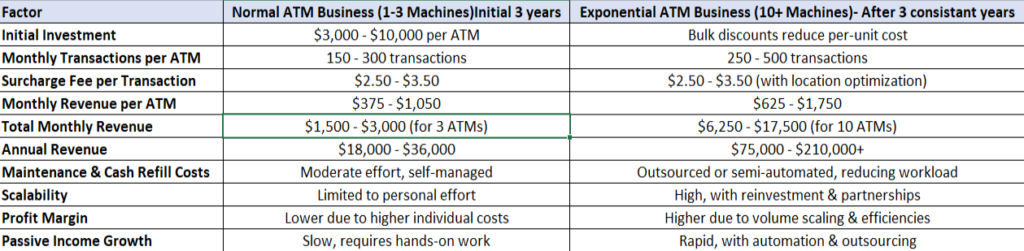

Scalability and Growth Potential

An ATM Business is highly scalable, meaning you can start with a single machine and gradually expand as you generate profits. Unlike other businesses that require hiring more employees or renting additional office space, adding more ATMs only requires finding new locations and making strategic investments. The more machines you place in high-traffic areas, the higher your earnings. Many successful ATM entrepreneurs start with one or two machines and, over time, expand to dozens, creating a profitable and sustainable business with minimal overhead.

High Demand in Cash-Dependent Locations

Despite the growing use of digital payments, cash transactions remain an essential part of many businesses. Convenience stores, gas stations, bars, and nightclubs often rely on cash transactions, making ATMs in these locations highly valuable. Customers appreciate having easy access to cash, and business owners benefit from increased foot traffic and reduced credit card processing fees. By strategically placing your ATM Business in a location where cash is frequently used, you can ensure a steady flow of transactions, maximizing your earnings.

Flexibility and Minimal Overhead Costs

One of the key benefits of an ATM Business is its flexibility. Unlike traditional businesses that require managing employees, inventory, and customer service, an ATM Business allows you to operate on your own terms. You can choose how many ATMs to own, where to place them, and how involved you want to be in the business. Additionally, since you don’t need to rent office space or invest in expensive marketing campaigns, your overhead costs remain low. This flexibility makes the ATM Business an attractive option for both full-time entrepreneurs and those looking for a side hustle.

Step 1: Conducting Market Research

Before investing in ATMs, conducting thorough market research is crucial. This ensures that you place your machines in locations with high foot traffic and demand.

Assessing Demand

Before investing in an ATM Business, evaluating demand in potential locations is crucial. Focus on areas where cash transactions are still prevalent, such as nightlife venues, event spaces, and cash-only businesses. Visit these locations and observe customer behavior to determine if there is a need for convenient cash access. For example, a bar that primarily accepts cash may have customers frequently asking where the nearest ATM is. This signals a potential opportunity to place an ATM and meet customer demand effectively. Learn more about how to get started with an ATM Business even if you have limited capital.

Competitor Analysis

Researching existing ATMs in your target locations helps you understand the competitive landscape. Identify where ATMs are currently located and assess their transaction volumes. Analyze surcharge fees and ATM uptime to determine if there is room for another machine. For instance, if a busy shopping area has only one ATM with long lines, placing your ATM nearby with a slightly lower surcharge fee could attract more customers and generate steady transactions. Check out this comprehensive ATM Business guide to understand more about competitive positioning.

Target Demographics

Knowing who uses ATMs most frequently can help you choose ideal locations. Tourists, cash-preferred customers, and businesses that rely on cash payments are common ATM users. If you’re placing an ATM near a tourist hotspot, consider the needs of international visitors who may need quick access to cash. Similarly, a business district with vendors who prefer cash payments can benefit from an easily accessible ATM, ensuring a consistent flow of transactions.

Data Collection

Utilizing data collection tools can enhance decision-making when selecting ATM locations. Foot traffic analytics tools can provide insights into customer movement patterns, helping determine the best placement for maximum usage. Additionally, conducting surveys with local business owners can provide direct feedback on customer demand for ATMs. For example, if a convenience store reports frequent customer requests for an ATM, it may be an ideal location to install one and secure a profitable business agreement.

Step 2: Understanding Legal Requirements

Complying with legal and regulatory requirements is essential for operating an ATM Business smoothly. Here are the key aspects to consider:

Business Registration

To legally operate an ATM Business, you must register it as a formal entity such as an LLC or corporation. This process not only legitimizes your business but also protects your personal assets from potential liabilities. Registering your ATM business as an LLC provides tax benefits and separates your personal and business finances, ensuring compliance with financial regulations. For instance, if an ATM malfunctions or a legal dispute arises, your personal assets remain protected. Proper registration also makes it easier to establish relationships with banks and service providers, which are crucial for cash handling and transaction processing. Get expert assistance with setting up your ATM Business the right way.

Permits and Licenses

Depending on the state and city where you plan to operate, specific permits and licenses may be required to install ATMs in public areas. Some municipalities have zoning laws that regulate ATM placements, while others may impose fees for ATM installations in high-traffic locations. To avoid legal issues, research local government requirements before installing an ATM. For example, in some cities, business owners must obtain a vending license or an ATM placement permit to operate legally. Ensuring compliance from the beginning will prevent fines and potential shutdowns, allowing your ATM Business to run smoothly.

Banking Regulations

Operating an ATM Business involves handling large amounts of cash, making compliance with banking regulations essential. The Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws require ATM owners to maintain accurate records and report suspicious transactions. Failure to comply with these financial laws can result in severe penalties, including fines and legal actions. For example, if an ATM in your network is used for illicit transactions, federal authorities may investigate your business. Partnering with a reputable ATM processor ensures compliance by automatically monitoring transactions for irregularities. Understanding and adhering to banking regulations will safeguard your ATM Business from legal and financial risks.

Contract Agreements

Before placing an ATM at a business location, it is crucial to draft a legally binding contract agreement with the property owner. This agreement outlines revenue-sharing terms, maintenance responsibilities, and contract duration, preventing disputes between both parties. A well-structured contract ensures that both you and the property owner benefit from the ATM installation. For instance, if you agree to share a percentage of surcharge revenue with a store owner, having it documented protects you from potential conflicts. Clear, legally binding agreements provide long-term stability and establish trust, making it easier to scale your ATM Business by securing multiple locations.

Step 3: Selecting the Right ATM Machines

Choosing the best ATM for your business is crucial for long-term success. Consider the following factors:

Machine Features

Choosing an ATM with the right features is essential for a smooth and profitable ATM Business. Modern machines should include EMV chip readers for secure transactions, a high cash capacity to reduce restocking frequency, and remote monitoring capabilities for real-time status updates. For example, an ATM equipped with remote monitoring can notify you when cash levels are low, preventing downtime and ensuring continuous service. Investing in feature-rich ATMs not only enhances user experience but also reduces maintenance efforts, making your ATM Business more efficient.

Cost and Maintenance

Balancing initial investment and ongoing maintenance is crucial when selecting an ATM. New ATMs may have higher upfront costs but come with warranties and the latest security features, while used machines can be a budget-friendly alternative with lower startup expenses. However, used ATMs might require more frequent servicing, leading to increased operational costs. For example, purchasing a refurbished ATM for a high-traffic location may save you money initially, but unexpected repairs can cut into your profits. Weighing the cost versus maintenance needs will help ensure long-term success in your ATM Business.

Reliable Suppliers

Purchasing your ATMs from reputable suppliers ensures durability, security, and ongoing support for your ATM Business. Trusted brands like Hyosung, Genmega, and Triton offer reliable machines that comply with financial regulations and provide excellent performance. For example, a Genmega ATM placed in a busy retail store can handle hundreds of transactions daily with minimal issues, maximizing your earnings. Working with a well-known supplier also provides access to maintenance services and software updates, keeping your ATM Business running smoothly with minimal disruptions.

Location Selection and Site Agreements

Finding the right location is key to maximizing profits. High-traffic areas such as convenience stores, gas stations, and shopping centers are ideal for ATM placements. When negotiating site agreements, consider offering a revenue-sharing model to incentivize business owners to host your ATM. Learn more about ATM Business location strategies to optimize placements for higher revenue.

Operational Steps to Launch the Business

Secure Funding

Starting an ATM Business requires an initial investment for purchasing machines, installing them, and ensuring cash liquidity. If you don’t have the necessary capital upfront, consider financing options such as small business loans, equipment leasing, or investor partnerships. For example, some ATM vendors offer financing plans that allow you to acquire machines with low upfront costs and pay over time from transaction earnings. Seeking funding through business credit lines or partnering with local business owners can also help you launch your ATM Business with minimal financial strain.

Purchase and Install ATMs

Once funding is secured, the next step is purchasing reliable ATMs and installing them in high-traffic locations. Choosing a model that meets transaction volume needs and security requirements is critical for long-term success in your ATM Business. After selecting your machines, work with certified technicians to ensure proper installation and connectivity. For example, installing an ATM inside a busy gas station with 24/7 accessibility can increase transaction volume, leading to higher profits. Proper placement, security measures, and compliance with ADA regulations ensure smooth operations and customer convenience. Get step-by-step guidance on purchasing and installing ATMs from this comprehensive ATM Business guide.

Connect to a Processing Network

An essential part of running an ATM Business is connecting your machines to a secure processing network that facilitates transactions. ATM processing companies handle cash withdrawals, authorize transactions, and ensure that users can access their funds. Partnering with a reputable processor enables smooth transactions and seamless integration with banking networks. For instance, working with an established processor like CDS or Switch Commerce ensures faster transaction speeds, reducing downtime and increasing customer satisfaction. A strong processing network keeps your ATM Business running efficiently and securely. Learn how to set up your processing network through this expert guide.

Monitor and Maintain ATMs

Keeping your ATMs operational is key to maximizing profitability in your ATM Business. Regular maintenance includes checking cash levels, updating software, and troubleshooting technical issues. Many modern ATMs come with remote monitoring systems that alert owners when cash supplies are low or if the machine encounters errors. For example, if an ATM located in a nightclub frequently runs out of cash on weekends, setting up an automated alert system ensures timely refills, preventing lost revenue. Consistent maintenance and monitoring help improve customer experience and sustain long-term profits in your ATM Business.

Maximizing Profits and Managing Operations

To ensure profitability, implement the following strategies:

Set Competitive Surcharge Fees

One of the most effective ways to maximize profits in your ATM Business is by setting competitive surcharge fees. Researching local ATM fees helps determine a profitable yet reasonable rate that attracts users without discouraging transactions. If the average surcharge fee in your area is $3.50, setting your fee slightly lower at $3.25 can give your ATM Business a competitive edge. Additionally, adjusting fees based on location type—such as higher fees at nightclubs and lower fees at convenience stores—can optimize revenue generation while keeping customer satisfaction high.

Monitor Transaction Volume

Tracking transaction patterns is essential for ensuring your ATMs operate at peak profitability. Using ATM monitoring software, you can analyze usage data, detect low-performing machines, and relocate them to higher-traffic locations. For instance, if an ATM inside a small retail store processes fewer than 100 transactions per month, relocating it to a nearby gas station or a high-foot-traffic mall entrance could significantly increase transaction volume. Regularly reviewing transaction data allows you to make informed decisions that enhance your ATM Business profitability while minimizing operational inefficiencies.

Expand Your Network

Scaling your ATM Business is one of the best ways to increase revenue over time. Once you start generating steady profits from your initial machines, reinvesting in additional ATMs allows for exponential growth. Instead of relying on a single location, spreading machines across various high-traffic areas—such as shopping centers, entertainment venues, and transportation hubs—creates multiple income streams. Many successful ATM operators begin with one or two ATMs and gradually expand to dozens, leveraging reinvested profits to scale their operations efficiently. Learn more about scaling your ATM Business for long-term success.

Conclusion

Starting an ATM Business in just three steps—conducting market research, understanding legal requirements, and selecting the right ATMs—can pave the way for long-term financial success. With low overhead costs, passive income potential, and high demand in cash-dependent areas, this business offers an excellent opportunity for entrepreneurs. By securing profitable locations, maintaining efficient operations, and optimizing surcharge fees, you can maximize earnings and scale your ATM Business over time.

If you’re ready to enter the ATM Business, now is the perfect time to take action and start building a profitable venture. Begin your journey today and secure your first ATM location!

Pingback: ATM Business: Crave $5,000 Monthly with Smart Strategies