How to make passive income through ATM Business without quitting 9-5.

Yes, you can start an ATM business without money in the United States, but it requires strategic planning, leveraging financial resources, and forming key partnerships. While an ATM business typically requires capital for machine purchases, location leasing, and maintenance, several ways exist to minimize or eliminate these upfront costs. Entrepreneurs can utilize financing options, negotiate placement agreements with businesses, and explore partnership opportunities to establish and grow their ATM business with little to no initial investment. If you want to learn a proven method to start an ATM business without risking your own money, check out this expert guide.

Understanding the ATM Business Model

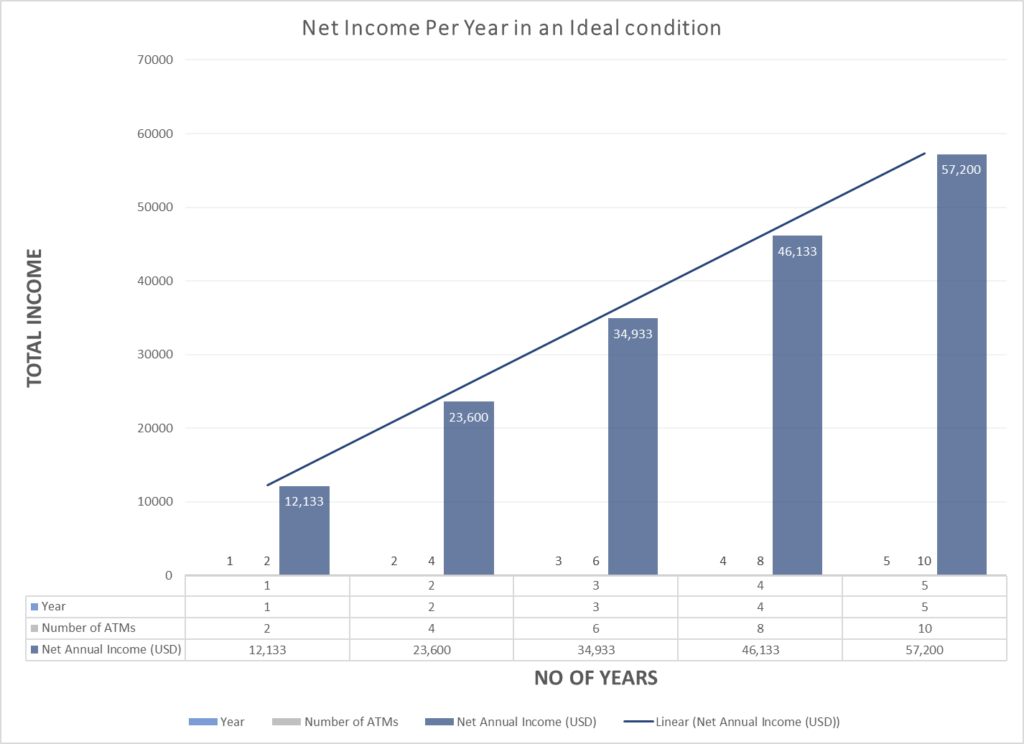

An ATM business operates by placing cash-dispensing machines in high-traffic locations. Each time a customer withdraws money; the ATM owner earns a surcharge fee. The more transactions an ATM processes, the higher the revenue. Successful operators focus on placing machines in strategic locations and ensuring they remain operational with adequate cash flow and maintenance. Want to see how this model can work for you? Explore real-world ATM success stories.

Leveraging Financing Options

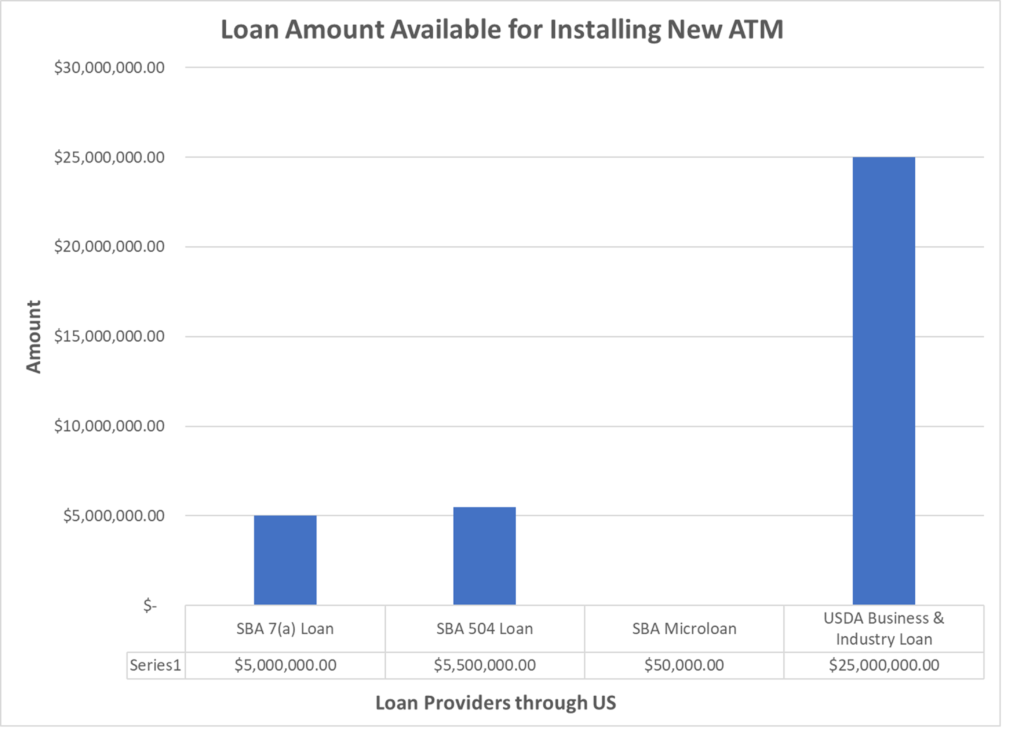

One way to start an ATM business without upfront capital is by utilizing financing options. Here are a few ways to secure funds:

- Small Business Loans: Entrepreneurs can apply for loans from banks, credit unions, or alternative lenders to cover initial costs. For example, the Small Business Administration (SBA) offers loan programs that can help fund your ATM purchase and setup, making it easier to get started. Learn more about financing options.

- Equipment Financing: Some ATM vendors offer financing programs that allow business owners to acquire ATMs with little to no money down, paying off the cost over time. For instance, companies like Ascendum Capital provide leasing options where you can spread out payments over several months instead of paying upfront. Find out how equipment financing can work for you.

- Investor Partnerships: Partnering with investors who are willing to fund the business in exchange for a share of the profits can be an effective way to start without personal capital. Discover how to attract investors for your ATM business.

Forming Strategic Partnerships

Strategic partnerships can significantly reduce costs when starting an ATM business. Some key partnerships include:

- Retail Businesses: Business owners looking to increase customer traffic may be willing to host an ATM at no cost to the ATM owner in exchange for a portion of the surcharge fees. See how to negotiate profitable retail partnerships.

- ATM Processors: Some ATM processing companies offer placement programs where they handle cash replenishment, maintenance, and security, allowing entrepreneurs to start without upfront investment. Companies like National Link or PAI can provide such services, making it easier for beginners to enter the market. Compare the best ATM processors.

- Banks and Financial Institutions: Partnering with banks can provide access to cash replenishment services and more favorable transaction processing rates. Find out how to establish bank partnerships.

Negotiating Placement Agreements

Finding the right location is essential for an ATM business. Instead of paying high leasing fees, new ATM owners can negotiate placement agreements with business owners who benefit from having an ATM on-site. Some strategies include:

- Offering a revenue-sharing model where the business owner receives a portion of the surcharge fees. Learn the best negotiation tactics.

- Placing ATMs in businesses with high foot traffic, such as convenience stores, gas stations, and nightclubs, ensures steady transaction volumes. See top-performing ATM locations.

- Exploring agreements with event venues that need temporary ATMs during high-demand periods. Discover how to land profitable short-term deals.

Alternative Perspectives and Challenges

While starting an ATM business with no money is possible, there are challenges to consider. ATM owners must ensure machines are secure, maintain regulatory compliance, and establish a reliable cash flow. Additionally, some businesses may be hesitant to place ATMs without an upfront investment. However, with persistence, networking, and creative financing solutions, entrepreneurs can overcome these obstacles and build a profitable ATM business. Learn how successful entrepreneurs navigate these challenges.

Conclusion

Starting an ATM business in the United States with no money is challenging but achievable with the right approach. By leveraging financing options, forming strategic partnerships, and negotiating placement agreements, aspiring entrepreneurs can enter the industry with minimal upfront costs. With careful planning, research, and persistence, an ATM business can provide a lucrative passive income stream. If you’re serious about starting an ATM business and want a step-by-step guide from experts, get exclusive insights here.

Pingback: How to Start an ATM Business In 3 Easy and Simple Steps?

Pingback: 5 Powerful Ways A Cash Machine Makes You Richer 2025

Pingback: ATM Business: Start Your ATM Machine Franchise USA In 2025